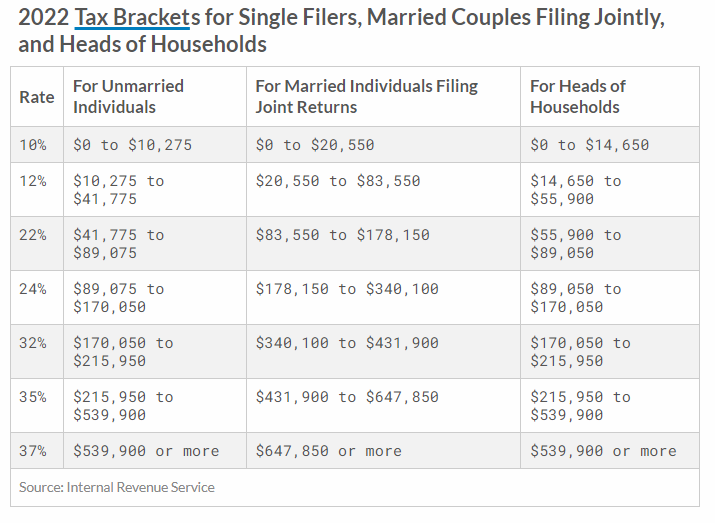

2022 tax brackets

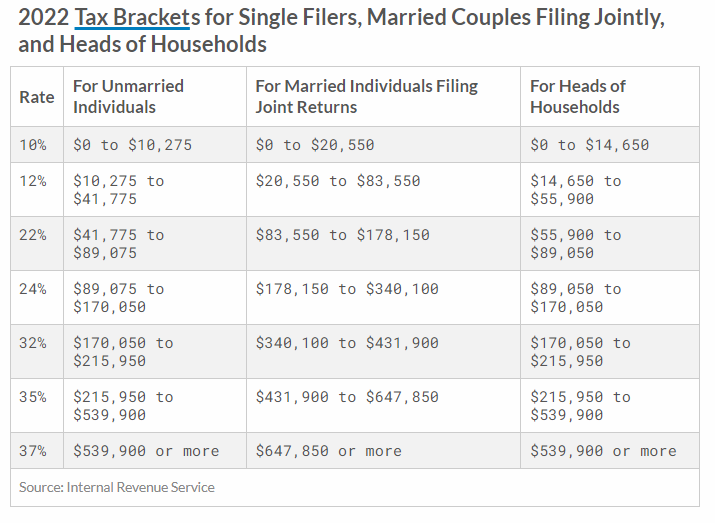

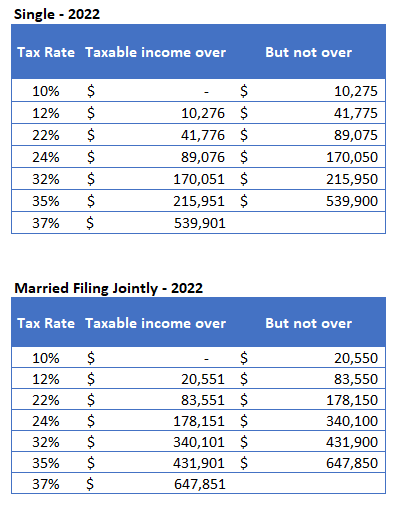

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. 6220 plus 22 of the amount over 54200.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

However as they are every year the 2022 tax brackets were adjusted to account for inflation.

. The other rates are. The federal income tax rates for 2022 did not change from 2021. There are seven tax rates in 2022.

10 12 22 24 32 35 and 37. There are still seven tax rates in effect for the 2022 tax year. Heres how they apply by filing status.

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household. 10 of taxable income. Whether you are single a head of household married etc.

2022 Tax Bracket and Tax Rates. There are seven federal income tax rates in 2022. 13293 plus 24 of the amount over 86350.

Tax rate Federal income tax bracket Tax owed. 10 12 22 24 32 35 and 37. Taxable income between 41775 to 89075.

Download the free 2022 tax bracket pdf. Taxable income between 89075 to 170050. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Taxable income up to 10275. 1420 plus 12 of the amount over 14200. 10 12 22 24 32 35 and 37 depending on the tax bracket.

2022 tax brackets are here. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Taxable income between 10275 to 41775.

6 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. 32145 plus 32 of the amount. 35 for incomes over 215950 431900 for married couples filing jointly.

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

Jbg Accounting Consultancy New Tax Table 2018 2022 Facebook

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

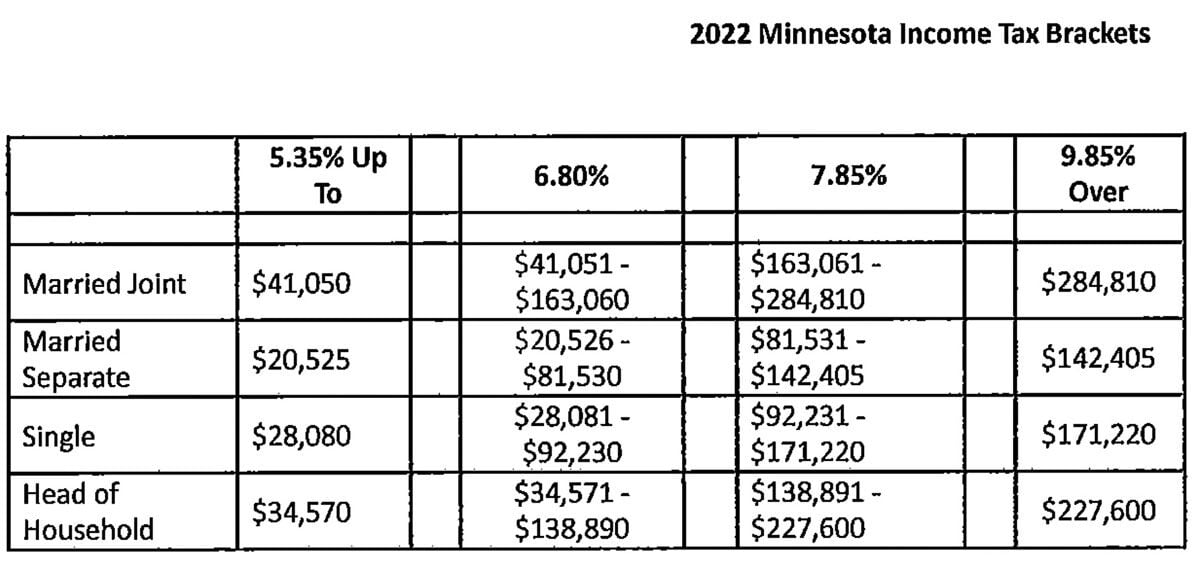

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

2022 Income Tax Brackets And The New Ideal Income

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Tax Brackets Darrow Wealth Management

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Twitter এ Tax Foundation 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw ট ইট র

2021 2022 Federal Income Tax Brackets And Rates

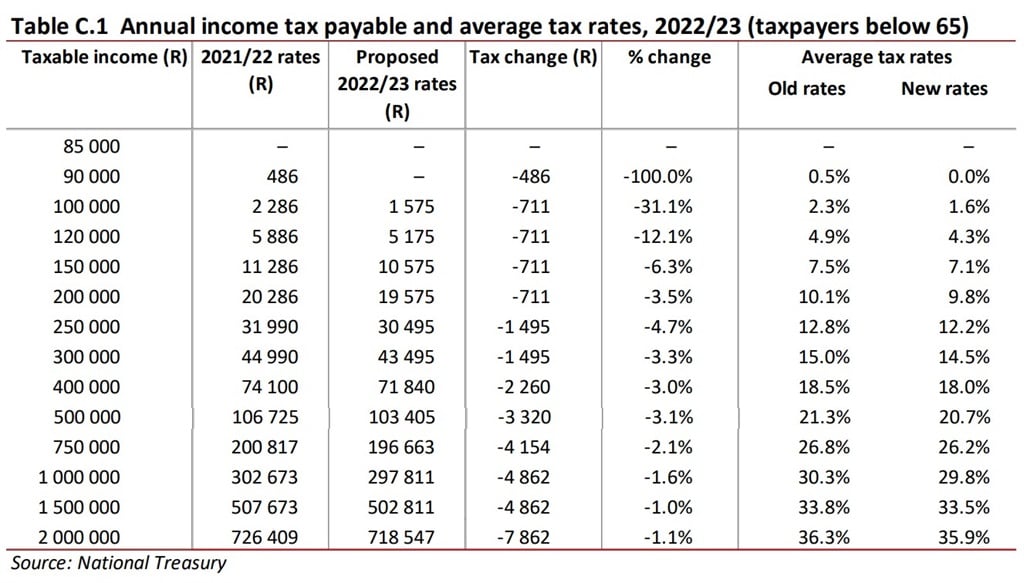

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Tax Brackets Canada 2022 Filing Taxes

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Budget Highlights For 2021 22 Nexia Sab T